Financial Statement Analysis Identifying Key Insights

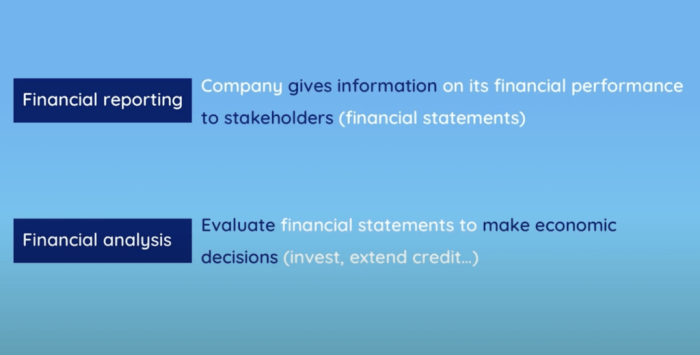

Financial statement analysis is primarily used to identify a company’s hidden truths – its triumphs, its follies, and occasionally, its outright lies. Think of it as a financial detective story, where the balance sheet and income statement are the crime scenes, and you, the intrepid analyst, are searching for clues. We’ll unravel the mysteries behind profitability trends, liquidity concerns, and operational efficiencies, all while dodging the occasional accounting red herring. This journey will equip you with the skills to not only understand a company’s financial health but also to spot potential problems before they become full-blown catastrophes (or, at the very least, before they tank your investment).

This exploration delves into the practical application of financial statement analysis, moving beyond theoretical concepts to provide concrete examples and techniques. We’ll examine key ratios, explore trend analysis, and even touch upon the thrilling world of fraud detection. By the end, you’ll be able to confidently interpret financial statements, making informed decisions based on solid data rather than gut feelings (though a healthy dose of intuition never hurts!).

Identifying Financial Health

So, you’ve got a company’s financial statements – a beautiful, bewildering mess of numbers, right? Fear not, intrepid analyst! We’re about to unravel the mysteries within, transforming those seemingly random digits into a clear picture of a company’s financial well-being. Think of it as financial archaeology, but instead of digging for bones, we’re digging for… well, more numbers. But these numbers tell a story, a story of profitability, liquidity, and overall financial health. And we’re here to translate.

Financial statement analysis reveals a company’s overall financial health through key indicators. These indicators act like financial vital signs, revealing whether the company is thriving, merely surviving, or teetering on the brink of disaster. By carefully examining these indicators, we can assess a company’s ability to meet its short-term and long-term obligations, its profitability, and its overall efficiency. It’s like giving the company a comprehensive financial physical – only instead of a stethoscope, we use ratios and formulas.

Liquidity Ratios and Solvency Issues

Liquidity ratios are like a company’s emergency fund – showing its ability to meet its short-term obligations. A low liquidity ratio suggests potential solvency issues, meaning the company might struggle to pay its bills. Imagine a company with fantastic long-term prospects but no cash on hand to pay its employees next week. That’s a liquidity problem, and those problems can sink even the most promising ventures. Common liquidity ratios include the current ratio (current assets divided by current liabilities) and the quick ratio (a more conservative measure, excluding inventory from current assets). A current ratio significantly below 1.0 raises red flags, suggesting the company might struggle to pay its immediate debts. The quick ratio provides an even more stringent test, as it considers only the most liquid assets. For example, a company with a current ratio of 0.8 might be considered financially vulnerable, especially if its quick ratio is even lower.

Profitability Ratios and Operational Efficiency

Profitability ratios are the ultimate measure of a company’s ability to generate profits. They reveal the efficiency of its operations and the strength of its earnings power. A high profitability ratio generally indicates a healthy and efficient company, while low ratios may signal problems with cost control, pricing strategies, or overall market competitiveness. Think of it as the company’s batting average in the financial world – a higher average means more runs (profits)!

| Ratio | Formula | Interpretation | Example |

|---|---|---|---|

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Measures profitability after deducting direct costs. | A gross profit margin of 40% indicates that 40% of revenue remains after covering direct costs. |

| Net Profit Margin | Net Income / Revenue | Measures overall profitability after all expenses. | A net profit margin of 10% indicates that 10% of revenue is net profit. |

| Return on Equity (ROE) | Net Income / Shareholders’ Equity | Measures the return generated on shareholder investments. | An ROE of 15% suggests a 15% return on shareholder investments. |

Detecting Profitability Trends

Profitability, that tantalizing dance between revenue and expenses, is the lifeblood of any business. Understanding its trends isn’t just for accountants; it’s crucial for anyone wanting to see if a company is swimming in champagne or desperately clinging to a financial life raft. Analyzing profitability trends reveals whether a company’s performance is improving, stagnating, or heading south faster than a debt-ridden Galapagos tortoise.

Analyzing profitability trends requires a multi-period perspective, akin to watching a slow-motion replay of a financial game. By examining financial statements over several years – say, three to five – we can discern meaningful patterns. This isn’t just about comparing year-to-year numbers; it’s about understanding the *why* behind the changes. Did profits surge due to clever marketing, or did costs magically plummet? The answers lie within the details.

Profitability Trend Identification Using Financial Statement Data

Identifying upward or downward trends involves calculating key profitability ratios over multiple periods. For instance, tracking the Gross Profit Margin (Revenue – Cost of Goods Sold / Revenue) year over year can show if a company is effectively managing its production costs. Similarly, monitoring the Net Profit Margin (Net Income / Revenue) reveals how much profit remains after all expenses are paid. A consistent increase in these margins suggests positive profitability trends, while a decrease indicates potential problems. Visualizing this data using line graphs provides a clear, concise picture – think of it as a financial electrocardiogram for the company’s heart.

Comparison to Industry Benchmarks

Comparing a company’s profitability to industry benchmarks is akin to comparing your child’s height to the average height for their age group. It provides context. A company boasting a high net profit margin might seem impressive in isolation, but if its competitors consistently achieve higher margins, it might signal areas for improvement. Industry benchmarks, often found in industry reports or databases like IBISWorld, offer a crucial reality check. They allow for a relative assessment of performance, helping to separate truly exceptional profitability from merely adequate performance.

Analyzing Sources of Changes in Profitability

Understanding the *why* behind profitability changes is critical. Dissecting the components of profit reveals the drivers of success or failure.

- Revenue Growth Analysis: Examining revenue growth rates and identifying the sources of this growth (e.g., increased sales volume, higher prices, new product launches) provides insight into the top-line drivers of profitability. For example, a company might see a jump in revenue due to successful marketing campaigns, indicating a positive trend. Conversely, stagnant revenue despite cost-cutting efforts might highlight market saturation or pricing issues.

- Cost Control Measures: Analyzing changes in cost of goods sold, operating expenses, and other expense categories sheds light on the efficiency of cost management. A decrease in these costs relative to revenue can significantly boost profitability. Imagine a company that successfully negotiates lower raw material prices; this directly translates to higher profit margins. Conversely, a consistent rise in operating expenses despite flat revenue signals a need for cost-control strategies.

- Financial Leverage Analysis: Examining the impact of debt financing on profitability is crucial. While debt can amplify profits, it also increases risk. A high debt-to-equity ratio might inflate profitability in the short term but could be detrimental in the long run, potentially leading to financial distress. Analyzing the interest expense component of the income statement helps to assess the financial burden of debt.

Assessing Solvency and Liquidity

So, we’ve tackled profitability – the thrilling pursuit of making money. Now, let’s dive into the slightly less glamorous, but equally crucial, world of solvency and liquidity. Think of it as the difference between having a fat bank account (profitability) and actually being able to pay your bills on time (solvency and liquidity). It’s a bit like the difference between winning the lottery and actually being able to cash the ticket – a crucial distinction!

Financial statements, those seemingly endless spreadsheets, are our trusty maps in this navigational quest. They reveal whether a company is a financial tightrope walker teetering on the edge of disaster, or a financially stable juggernaut cruising down the highway of success. By analyzing key ratios derived from these statements, we can gain invaluable insights into a company’s ability to meet its financial obligations – both short-term (like paying suppliers) and long-term (like repaying loans). Ignoring this crucial aspect is like driving a car without checking your fuel gauge – you might end up stranded!

Key Financial Ratios Indicating Solvency Risk

Understanding a company’s solvency hinges on examining its ability to meet its long-term obligations. Several key ratios offer a window into this critical area. A low debt-to-equity ratio, for instance, suggests a company relies less on borrowed funds and is therefore less vulnerable to financial distress. Conversely, a high ratio might signal increased risk, as a substantial portion of the company’s financing comes from debt. Imagine a tightrope walker carrying a heavy backpack – the heavier the pack (debt), the greater the risk of a fall. Similarly, a high times interest earned ratio indicates a company’s ability to comfortably cover its interest expenses, implying lower solvency risk. On the other hand, a low ratio suggests the company is struggling to meet its interest payments, putting its long-term solvency in jeopardy. Think of it as having enough money to make your monthly mortgage payments – a crucial aspect of maintaining a stable financial life.

Liquidity Ratios: A Deep Dive

Liquidity, on the other hand, focuses on a company’s ability to meet its short-term obligations. The current ratio, a popular measure, compares current assets to current liabilities. A high current ratio, for example, signifies that a company possesses ample liquid assets to cover its immediate debts. This suggests a strong ability to meet its short-term obligations, providing a buffer against unexpected financial setbacks.

A high current ratio suggests a company has more than enough liquid assets to cover its short-term liabilities, offering a safety net against unexpected expenses or downturns in business. This can be a positive indicator of financial health, implying strong liquidity and reduced short-term financial risk. However, an excessively high current ratio might also suggest that the company isn’t effectively utilizing its assets – the money could be better invested elsewhere to generate returns. Finding the sweet spot is key.

Uncovering Operational Efficiency

Financial statement analysis isn’t just about staring at numbers until your eyes glaze over (though that’s part of the charm, isn’t it?). It’s about uncovering the hidden stories within those spreadsheets, particularly the tale of operational efficiency. Think of it as corporate archaeology – digging through the financial remains to unearth clues about how smoothly (or clumsily) a business runs. We’ve already tackled the big picture – financial health and profitability – but now we delve into the nitty-gritty of day-to-day operations.

Operational efficiency, in a nutshell, is about maximizing output with minimal input. It’s about squeezing every drop of productivity from your resources, like a particularly frugal accountant on a business trip. Analyzing financial statements reveals how effectively a company manages its assets and processes to generate revenue. We’ll use key ratios to assess inventory management, accounts receivable collection, and overall resource utilization. Prepare to be amazed (or perhaps mildly amused) by the insights we unearth.

Inventory Turnover Ratio and Days Sales of Inventory

The inventory turnover ratio reveals how efficiently a company sells its inventory. A high ratio suggests strong sales and effective inventory management, while a low ratio might indicate slow-moving inventory, potential obsolescence, or perhaps a misguided belief in the power of hoarding. The calculation is:

Cost of Goods Sold / Average Inventory.

The average inventory is typically calculated as (Beginning Inventory + Ending Inventory) / 2. Let’s say a company has a Cost of Goods Sold of $1,000,000 and an average inventory of $200,000. Their inventory turnover ratio would be 5, meaning they sell their entire inventory five times a year. This is good! However, comparing this to industry benchmarks is crucial for a truly meaningful interpretation. A related metric, Days Sales of Inventory (DSI), tells us how many days it takes to sell the average inventory. The formula is:

(Average Inventory / Cost of Goods Sold) * 365.

In our example, DSI would be 73 days (200,000/1,000,000 * 365).

Days Sales Outstanding

Days Sales Outstanding (DSO), also known as the average collection period, measures how long it takes a company to collect payment from its customers after a sale. A high DSO indicates potential problems with credit policies, inefficient collection processes, or perhaps overly generous payment terms (the kind that make accountants weep). The calculation is:

(Average Accounts Receivable / Net Credit Sales) * 365.

Imagine a company with average accounts receivable of $500,000 and net credit sales of $2,000,000. Their DSO would be 91.25 days. Again, industry benchmarks are vital for proper context. A high DSO might signal the need for stricter credit policies or more aggressive collection efforts, while a low DSO could indicate a healthy cash flow cycle.

Operational Efficiency Ratios

The following table showcases different operational efficiency ratios and their interpretations. Remember, context is key! These ratios are most useful when compared to industry averages and the company’s own historical performance.

| Ratio | Formula | Interpretation | Example |

|---|---|---|---|

| Inventory Turnover | Cost of Goods Sold / Average Inventory | Higher is generally better, indicating efficient inventory management. | A turnover of 8 suggests efficient sales, while a turnover of 2 might indicate slow-moving inventory. |

| Days Sales Outstanding (DSO) | (Average Accounts Receivable / Net Credit Sales) * 365 | Lower is better, indicating quicker collection of receivables. | A DSO of 30 days is excellent, while a DSO of 120 days suggests potential problems. |

| Asset Turnover | Net Sales / Average Total Assets | Measures how effectively a company uses its assets to generate sales. Higher is generally better. | A high asset turnover ratio suggests efficient asset utilization. |

| Operating Profit Margin | Operating Income / Net Sales | Shows profitability after deducting operating expenses. Higher is better. | A higher operating profit margin suggests efficient cost control and pricing strategies. |

Evaluating Investment Performance

Investing in a company is like betting on a horse race – except instead of jockeys and mud, you’ve got balance sheets and profit margins. Understanding a company’s financial health is crucial to making smart investment decisions, and thankfully, financial statements provide a roadmap to riches (or at least, to avoiding financial ruin). This section will explore key metrics and techniques for evaluating investment performance, transforming you from a financial novice into a savvy investor (or at least, a slightly less clueless one).

Analyzing a company’s performance requires more than just looking at the bottom line. We need to dig deeper, examining how efficiently the company uses its assets and capital to generate returns. This involves a careful examination of key ratios and their interrelationships, providing a more holistic picture of the company’s investment potential. Think of it as a financial detective story – the clues are all there, we just need to learn how to decipher them.

Return on Assets (ROA) and Return on Invested Capital (ROIC)

Return on Assets (ROA) and Return on Invested Capital (ROIC) are two crucial metrics for evaluating a company’s efficiency in generating profits from its assets and invested capital. ROA measures how effectively a company uses its assets to generate earnings, while ROIC focuses on the return generated from the total capital invested in the business. A higher ROA and ROIC generally indicate better investment performance, reflecting efficient asset management and strong profitability. For example, a company with a consistently high ROA compared to its industry peers suggests superior operational efficiency and potentially a more attractive investment opportunity. Conversely, a declining ROIC might signal declining profitability and potentially weaker investment prospects. The calculation for ROA is:

Net Income / Total Assets

while ROIC is calculated as:

Net Operating Profit After Tax (NOPAT) / Invested Capital

. Remember, context is key! Comparing these metrics across industries requires careful consideration of industry-specific factors.

Comparing Investment Opportunities Using Financial Statements

Financial statements provide a standardized framework for comparing the performance of different investment opportunities. By analyzing key ratios like ROA, ROIC, profit margins, and liquidity ratios across several companies within the same industry, investors can identify companies with superior performance and potentially higher returns. For example, comparing the ROA of two companies in the technology sector can reveal which company is more efficient in utilizing its assets to generate profits. Further analysis of other financial metrics can then provide a more comprehensive picture of each company’s financial health and overall investment attractiveness. This process helps investors make informed decisions by highlighting companies with strong fundamentals and sustainable growth potential.

Financial Leverage and Return on Equity (ROE)

Financial leverage, representing the proportion of debt financing used by a company, has a significant impact on its return on equity (ROE). ROE measures the profitability of a company relative to the shareholders’ equity. A higher ROE generally indicates better returns for investors. However, increasing financial leverage, while potentially boosting short-term ROE, also increases financial risk. A highly leveraged company, while potentially showing a high ROE, faces greater vulnerability to economic downturns and interest rate fluctuations. Imagine a seesaw: Increased leverage is like adding more weight to one side – it can make the ROE shoot up, but it also makes the whole thing much more unstable. The relationship between financial leverage and ROE isn’t always linear; it’s crucial to assess the overall risk profile of the company alongside its ROE to make informed investment decisions. For example, a company with a high ROE achieved through excessive debt might be a riskier investment than a company with a slightly lower ROE but a more conservative capital structure.

Identifying Potential Fraud or Misstatements

Financial statement analysis isn’t just about admiring the pretty numbers; it’s also a crucial tool for sniffing out potential shenanigans. Think of it as a financial detective’s handbook, helping you uncover hidden clues that might point to fraudulent activity or simple, yet embarrassing, accounting errors. While we can’t promise to turn you into Sherlock Holmes overnight, we can equip you with the tools to identify some common red flags.

Analyzing financial statements for fraud requires a keen eye for inconsistencies and anomalies. It’s a bit like playing “spot the difference” with millions of dollars at stake. The goal is to identify discrepancies that warrant further investigation, potentially uncovering hidden issues before they snowball into major problems. This often involves a thorough examination of individual line items, comparing them to industry benchmarks, and scrutinizing the overall narrative presented by the financial statements. Remember, even the most sophisticated fraudsters leave traces, and a diligent analyst can often find them.

Common Red Flags Indicating Fraudulent Activity or Accounting Errors, Financial statement analysis is primarily used to identify

Several warning signs can signal potential problems. Unusual spikes or dips in revenue or expenses, for instance, might warrant closer inspection. Similarly, significant discrepancies between reported financial performance and operational results can raise eyebrows. A sudden surge in accounts receivable, coupled with a corresponding increase in bad debt expense, could hint at aggressive revenue recognition practices or even outright fabrication. Conversely, unexpectedly large increases in inventory without a commensurate increase in sales could indicate inventory inflation or obsolete goods being carried on the books. These are just a few examples; a thorough review is crucial.

Techniques for Cross-Referencing Financial Statements

Cross-referencing different sections of the financial statements is vital for uncovering inconsistencies. This process acts as a powerful internal audit, allowing for a holistic view of the financial health of the organization.

The following techniques are invaluable in this process:

- Comparing Revenue Recognition with Sales Data: Match revenue reported in the income statement to the underlying sales data. Significant discrepancies may signal manipulation of revenue figures.

- Reconciling Inventory Levels with Cost of Goods Sold: Verify that changes in inventory levels align with the cost of goods sold reported. Unexpectedly large increases in inventory without corresponding sales increases can be a red flag.

- Analyzing Accounts Receivable Turnover: A significantly slower-than-expected accounts receivable turnover rate might indicate problems with credit policies or potential bad debts.

- Matching Depreciation Expense with Fixed Asset Values: Ensure that the depreciation expense aligns with the value and useful life of fixed assets. Inconsistent depreciation methods or excessively high or low depreciation rates might point to issues.

- Scrutinizing Cash Flow Statements Against Operating Activities: A discrepancy between net income and cash flow from operating activities is often a significant red flag, possibly indicating aggressive accounting practices.

Detecting Inconsistencies and Anomalies Using Financial Ratios

Financial ratios provide a powerful lens for identifying inconsistencies. For example, a consistently high debt-to-equity ratio combined with declining profitability could suggest excessive reliance on debt financing and potential financial distress, possibly masking underlying issues. Similarly, a sudden and unexplained drop in the current ratio (current assets divided by current liabilities) might indicate liquidity problems. These ratios, when analyzed over time and in comparison to industry peers, can reveal patterns that might otherwise go unnoticed. Remember, context is crucial. While a single unusual ratio doesn’t automatically indicate fraud, a combination of unusual ratios and other red flags should trigger a deeper investigation.

Understanding Capital Structure

The capital structure of a company, that thrilling tightrope walk between debt and equity financing, is a key indicator of its financial health and risk appetite. Think of it as the company’s financial personality – is it a thrill-seeking daredevil or a cautious, steady Eddie? Financial statements, those often-overlooked treasure maps of corporate finance, provide the clues to decipher this personality.

Financial statements reveal a company’s capital structure by meticulously detailing its sources of funding. The balance sheet, that steadfast pillar of financial reporting, clearly Artikels the company’s liabilities (debt) and equity. The proportion of each reveals the company’s reliance on borrowed money versus owner’s investment. A high debt-to-equity ratio, for example, suggests a company that’s leaning heavily on borrowed funds, potentially increasing its financial risk but also potentially amplifying returns. Conversely, a low ratio indicates a preference for equity financing, often associated with lower risk but potentially slower growth. Analyzing these ratios over time reveals trends in a company’s financing choices and its overall financial strategy.

Capital Structure and Risk Profile

Different capital structures carry varying degrees of risk. Companies with high levels of debt face greater financial risk because they are obligated to make regular interest and principal payments, regardless of their profitability. This financial leverage, while potentially boosting returns in good times, can become a crushing weight during economic downturns. Imagine a tightrope walker carrying a heavy sack of potatoes – a small misstep could have disastrous consequences. Conversely, companies that rely primarily on equity financing are generally less risky, as they don’t face the same pressure to make debt payments. However, this often means slower growth, as equity financing usually comes with fewer strings attached but at a slower pace.

Advantages and Disadvantages of Debt Financing

Debt financing, while a risky business, offers several advantages. Interest payments on debt are tax-deductible, reducing the company’s overall tax burden. This tax shield can significantly improve a company’s profitability. Furthermore, debt financing can lead to faster growth as the company can leverage borrowed funds to invest in new projects or expand operations. However, the disadvantages are equally significant. High debt levels can lead to financial distress or even bankruptcy if the company fails to meet its debt obligations. Furthermore, the need to service debt can constrain the company’s flexibility and ability to respond to changing market conditions. Think of it like a speeding race car – exhilarating, but requires impeccable control and a well-maintained engine.

Advantages and Disadvantages of Equity Financing

Equity financing, on the other hand, offers a more stable, less risky path. It doesn’t require regular interest payments, and the company isn’t obligated to repay the principal. This provides greater financial flexibility. However, equity financing can dilute the ownership stake of existing shareholders and limit the company’s control. Moreover, raising equity capital can be a more complex and time-consuming process than securing debt financing. This is like a sturdy cargo ship – slower but more reliable and less susceptible to sudden storms.

Last Word

So, there you have it – a whirlwind tour of financial statement analysis. While we’ve only scratched the surface of this multifaceted field, you now possess the foundational knowledge to embark on your own financial investigations. Remember, the key is to be inquisitive, persistent, and perhaps slightly skeptical. After all, even the most seemingly pristine financial statements can conceal secrets, waiting to be uncovered by the sharp eyes of a skilled analyst. Happy analyzing!

Questions and Answers: Financial Statement Analysis Is Primarily Used To Identify

What’s the difference between liquidity and solvency?

Liquidity refers to a company’s ability to meet its short-term obligations (think paying bills this month). Solvency, on the other hand, focuses on its ability to meet its long-term debts (paying off loans over several years). A company can be liquid but not solvent, a precarious position indeed!

How often should I analyze financial statements?

The frequency depends on your needs. For short-term investments, monthly or quarterly analysis might be necessary. For long-term investments, annual reviews may suffice. The more volatile the industry, the more frequent the analysis should be.

Can I use financial statement analysis to predict the future?

While you can’t predict the future with certainty, financial statement analysis provides valuable insights into a company’s past performance and current financial health, allowing for more informed projections. It’s a crystal ball, but a slightly cloudy one.