Financial Statement Analysis for Investing

Financial statement analysis for investing: Unlocking the secrets hidden within balance sheets, income statements, and cash flow statements isn’t just for accountants; it’s the key to deciphering the cryptic language of corporate finance and making smart investment decisions. This guide will equip you with the tools to analyze a company’s financial health, predict its future performance, and ultimately, make your money work harder (or at least, not run away screaming).

We’ll journey through the fascinating world of financial ratios, exploring liquidity, profitability, solvency, and efficiency metrics. We’ll dissect income statements, balance sheets, and cash flow statements, uncovering hidden trends and potential pitfalls. Prepare for a thrilling ride as we unravel the mysteries of trend analysis, forecasting, and comparative company analysis. Buckle up, because understanding financial statements is about to become your new favorite adventure!

Introduction to Financial Statement Interpretation for Investment Decisions

Investing in the stock market can feel like navigating a pirate ship during a hurricane – thrilling, potentially lucrative, and utterly terrifying if you don’t know your way around. Understanding financial statements is your compass and sextant in this wild financial sea. Without them, you’re essentially throwing darts blindfolded at a map of the world, hoping to hit a treasure island. Let’s illuminate the path to financial literacy and investment success.

Financial statements are the lifeblood of any company, revealing its financial health, performance, and prospects. For investors, they are the crucial clues needed to unravel the mystery of a company’s value and potential for future growth. Analyzing these statements allows investors to make informed decisions, separating the promising gold mines from the glittering fool’s gold. Think of them as a company’s detailed autobiography, written in numbers and accounting jargon.

Types of Financial Statements

Three primary financial statements form the cornerstone of investment analysis: the balance sheet, the income statement, and the cash flow statement. Each offers a unique perspective on the company’s financial situation, much like viewing a sculpture from different angles to fully appreciate its artistry. Understanding each statement’s strengths and limitations is essential for a comprehensive analysis. Consider them as three distinct pieces of a puzzle, all necessary to create the complete picture.

The Balance Sheet: A Snapshot in Time

The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It’s like a photograph, capturing the company’s financial position on a particular date. The fundamental accounting equation,

Assets = Liabilities + Equity

, underpins the balance sheet. Assets represent what the company owns (cash, property, equipment), liabilities represent what it owes (loans, accounts payable), and equity represents the owners’ stake in the company. Analyzing the balance sheet reveals the company’s capital structure, liquidity, and solvency. For example, a high debt-to-equity ratio might signal a risky investment.

The Income Statement: A Story of Revenue and Expenses

The income statement, also known as the profit and loss statement, tracks a company’s revenue, expenses, and profits over a period of time. It’s like a movie, showing the company’s financial performance over a specific period, such as a quarter or a year. By analyzing revenue growth, cost structure, and profitability margins, investors can assess the company’s operational efficiency and its ability to generate profits. Key metrics like gross profit margin and net profit margin provide valuable insights into a company’s profitability. A consistently declining net profit margin, for instance, might indicate underlying problems.

The Cash Flow Statement: The Money Trail

The cash flow statement reveals the movement of cash both into and out of the company over a period. It’s like a detective’s trail, following the flow of money to understand where the company’s cash is coming from and where it’s going. It’s divided into operating, investing, and financing activities. This statement is crucial because profits don’t always equate to cash. A company might report high profits but still struggle with cash flow, a situation that could lead to financial distress. Analyzing cash flow helps investors assess the company’s ability to meet its short-term and long-term obligations. For example, consistent negative free cash flow is a major red flag.

Obtaining Financial Statements for Publicly Traded Companies, Financial statement analysis for investing

Accessing financial statements for publicly traded companies is surprisingly straightforward, thanks to the wonders of the internet. The primary sources are the company’s investor relations website and the Securities and Exchange Commission (SEC) website (for US-listed companies). Many financial news websites also provide access to these statements. Think of it as a treasure hunt with readily available clues. The SEC’s EDGAR database is a treasure trove of financial information. Simply search for the company’s ticker symbol, and voila! You’ll find the annual reports (10-K filings) and quarterly reports (10-Q filings), which contain the financial statements.

Ratio Analysis Techniques

Unlocking the secrets of a company’s financial health isn’t about reading tea leaves; it’s about wielding the powerful tools of ratio analysis. These ratios, derived directly from the financial statements, act as financial X-rays, revealing hidden strengths and weaknesses that can make or break an investment. Think of them as your trusty magnifying glass, allowing you to zoom in on the crucial details and make informed investment decisions, avoiding the pitfalls of relying solely on gut feeling.

Ratio analysis involves comparing different line items within a company’s financial statements to derive meaningful insights into its performance. By systematically evaluating these ratios, investors can gain a deeper understanding of a company’s liquidity, profitability, solvency, and efficiency. It’s like a financial detective story, where the ratios are the clues, and the astute investor is the Sherlock Holmes of the stock market.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. Essentially, they tell us if a company has enough readily available cash or assets to pay its bills on time. A company with poor liquidity is like a tightrope walker without a net – a single misstep could be disastrous. Conversely, a company with strong liquidity is like a well-funded explorer, prepared for any challenges the market might throw its way.

Profitability Ratios

Profitability ratios, on the other hand, assess a company’s ability to generate profits from its operations. These ratios delve into the heart of a company’s earnings power, providing insights into its efficiency and effectiveness in converting sales into profits. Imagine them as the financial heartbeat of a company – a strong pulse indicates a healthy, thriving business, while a weak one might signal underlying problems.

Solvency Ratios

Solvency ratios are the financial equivalent of a stress test. They gauge a company’s ability to meet its long-term obligations, providing a picture of its long-term financial stability. These ratios reveal whether a company can weather financial storms and remain afloat even during tough economic times. A company with strong solvency is like a sturdy ship, able to withstand even the roughest seas.

Efficiency Ratios

Efficiency ratios, sometimes called activity ratios, measure how effectively a company manages its assets and liabilities. These ratios reveal how efficiently a company utilizes its resources to generate sales and profits. Think of them as a measure of a company’s operational prowess – a well-oiled machine versus a rusty, creaking one.

Comparison of Ratio Analysis Methods and Applications

Different ratio analysis methods offer unique perspectives on a company’s financial health. For instance, comparing a company’s ratios to industry averages provides a benchmark for performance, while trend analysis reveals changes in a company’s financial position over time. Cross-sectional analysis compares a company’s ratios to those of its competitors, while common-size statements normalize financial statement data to facilitate comparison across different companies or time periods. Each method offers valuable insights, providing a holistic view of the company’s financial performance. Choosing the right method depends on the specific investment objective and the information available.

Key Financial Ratios and Interpretations

The following table summarizes several key financial ratios, their formulas, and interpretations, including examples of good and bad ratio values. Remember, these are guidelines, and the interpretation of a ratio should always be done in context. A single ratio rarely tells the whole story; it’s the combination of several ratios that paints a complete picture.

| Ratio | Formula | Interpretation | Good/Bad Example |

|---|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Measures short-term liquidity; higher is generally better. | Good: 2.0; Bad: 0.5 |

| Quick Ratio | (Current Assets – Inventory) / Current Liabilities | More conservative measure of short-term liquidity. | Good: 1.5; Bad: 0.2 |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Measures financial leverage; lower is generally better (less risky). | Good: 0.5; Bad: 2.0 |

| Return on Equity (ROE) | Net Income / Total Equity | Measures profitability relative to shareholder investment. | Good: 15%; Bad: 5% |

| Profit Margin | Net Income / Revenue | Measures profitability relative to sales. | Good: 10%; Bad: 2% |

| Inventory Turnover | Cost of Goods Sold / Average Inventory | Measures how efficiently inventory is managed. | Good: 6; Bad: 2 |

| Days Sales Outstanding (DSO) | (Accounts Receivable / Revenue) * 365 | Measures how quickly customers pay their invoices. | Good: 30 days; Bad: 90 days |

Analyzing the Income Statement

The income statement, that glorious document detailing a company’s financial performance over a period, is more than just a list of numbers; it’s a thrilling rollercoaster ride of revenues, expenses, and ultimately, profits (or, let’s be honest, sometimes losses). Understanding its nuances is crucial for any investor hoping to avoid a financial wipeout. Think of it as a financial detective story, where the clues lie in the numbers, waiting to be deciphered.

Analyzing the income statement involves scrutinizing key line items to uncover the narrative of a company’s financial health. We’ll be examining the story behind the numbers, looking for both the heroes (strong revenue growth) and the villains (unexpected expense spikes). This isn’t about simply reading the numbers; it’s about interpreting their meaning and implications for your investment decisions.

Key Income Statement Line Items and Their Investment Relevance

The income statement, like a well-crafted novel, has its key characters. Revenue, the star of the show, represents the total income generated from sales of goods or services. Cost of Goods Sold (COGS), the often-unsung hero, represents the direct costs associated with producing those goods or services. Gross Profit, the difference between revenue and COGS, is a crucial indicator of pricing power and efficiency. Operating Expenses, the supporting cast, encompass things like salaries, rent, and marketing. Operating Income (or EBIT – Earnings Before Interest and Taxes), the climax of the story, shows the profitability of the core business operations. Interest Expense, a sometimes unwelcome guest, represents the cost of borrowing. Taxes, the inevitable ending, are, well, taxes. Finally, Net Income, the ultimate conclusion, is the bottom line – the profit after all expenses and taxes are accounted for. Each of these elements provides valuable insights into a company’s financial performance and its potential for future growth. A sharp decline in revenue, for example, might signal a weakening market position, while consistently high operating expenses could indicate inefficiency.

Analyzing Revenue Growth, Profitability Margins, and Expense Trends

Analyzing revenue growth involves more than just looking at the raw numbers. We need to understand the *why* behind the growth. Is it due to increased sales volume, higher prices, or new product launches? A consistent upward trend is usually a good sign, but sudden jumps or drops require further investigation. Profitability margins, expressed as percentages, reveal how efficiently a company converts revenue into profit. Gross profit margin (Gross Profit / Revenue), operating profit margin (Operating Income / Revenue), and net profit margin (Net Income / Revenue) provide a comprehensive picture of profitability at different stages of the business process. Analyzing expense trends involves identifying any unusual increases or decreases. Are marketing expenses suddenly spiking? Are there signs of cost-cutting measures? Understanding these trends can reveal potential problems or opportunities. For example, a consistently high marketing expense coupled with stagnant revenue growth could indicate an ineffective marketing strategy.

Calculating Key Profitability Ratios

Let’s illustrate these calculations with a hypothetical example. Imagine “Widgets Inc.” reported the following: Revenue = $1,000,000; COGS = $400,000; Operating Expenses = $300,000; Interest Expense = $50,000; Taxes = $100,000.

Gross Profit Margin = (Revenue – COGS) / Revenue = ($1,000,000 – $400,000) / $1,000,000 = 60%

Operating Profit Margin = (Revenue – COGS – Operating Expenses) / Revenue = ($1,000,000 – $400,000 – $300,000) / $1,000,000 = 30%

Net Profit Margin = Net Income / Revenue = ($1,000,000 – $400,000 – $300,000 – $50,000 – $100,000) / $1,000,000 = 15%

These margins tell a story. Widgets Inc. has a healthy gross profit margin, indicating strong pricing power or efficient production. However, its operating and net profit margins are lower, suggesting that operating expenses are relatively high. This might warrant further investigation into the company’s cost structure. Comparing these ratios to industry averages and historical trends provides further context and insights into the company’s performance. Remember, context is king!

Analyzing the Balance Sheet: Financial Statement Analysis For Investing

The balance sheet, that steadfast snapshot of a company’s financial position at a specific point in time, is often overlooked in the thrill of chasing income statement numbers. But fear not, dear investor! Understanding the balance sheet is like unlocking a secret treasure map to a company’s true financial health. It reveals the intricate dance between assets, liabilities, and equity – a performance worthy of a standing ovation (or at least a thoughtful nod).

The balance sheet’s magic lies in its ability to illuminate the composition of a company’s assets, the structure of its liabilities, and the strength of its equity. This trinity provides crucial insights into a company’s solvency, liquidity, and overall financial stability. Think of it as a financial detective story, where each line item is a clue leading to the ultimate truth about the company’s financial wellbeing.

Asset Composition

Analyzing asset composition helps us understand how a company deploys its resources. A high proportion of current assets (like cash and accounts receivable) might suggest a company is liquid, but it could also indicate a lack of long-term investment. Conversely, a high proportion of fixed assets (like property, plant, and equipment) might signal a commitment to long-term growth, but it could also mean the company is less flexible and adaptable to changing market conditions. A balanced approach, reflecting a strategic allocation of resources, is usually preferred. For example, a tech startup might prioritize intangible assets (intellectual property), while a manufacturing company would lean heavily on tangible assets. The ideal asset composition varies significantly depending on the industry and business model.

Liability Structure

The liability structure reveals how a company finances its operations. A heavy reliance on short-term debt can be risky, making the company vulnerable to interest rate fluctuations and potential cash flow problems. Long-term debt, while offering stability, can burden the company with substantial interest payments over time. The optimal balance depends on several factors, including the company’s industry, growth prospects, and risk tolerance. A company with a healthy liability structure typically demonstrates a mix of short-term and long-term debt, strategically aligned with its business plan. Imagine a construction company heavily reliant on short-term loans for materials – a recipe for potential financial stress.

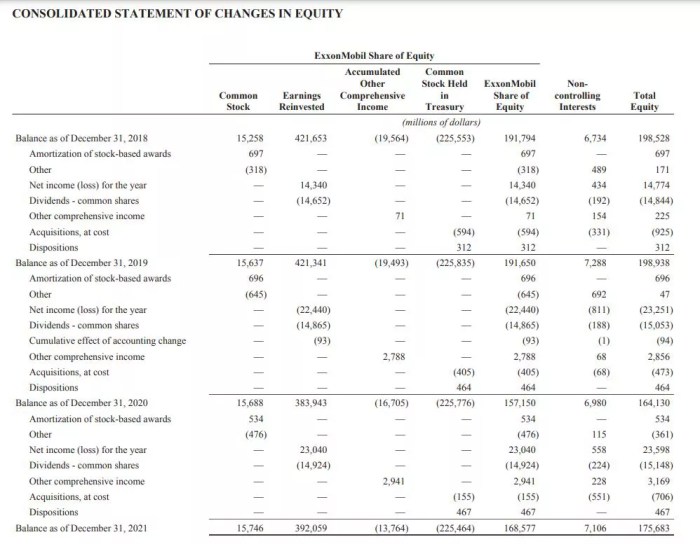

Equity Analysis

Equity represents the owners’ stake in the company. Analyzing equity reveals the company’s financial strength and its ability to absorb losses. A high equity-to-asset ratio indicates a strong financial foundation, suggesting lower financial risk. Conversely, a low ratio might signal higher risk, indicating greater reliance on debt financing. Moreover, tracking changes in retained earnings over time provides insights into the company’s profitability and its ability to reinvest earnings for future growth. For instance, a company consistently reinvesting its earnings might signal a long-term commitment to growth, while a company distributing a large portion of its earnings as dividends might prioritize immediate returns to shareholders.

Liquidity Ratios

Understanding a company’s ability to meet its short-term obligations is paramount. Liquidity ratios provide a quantitative measure of this ability. Two key ratios are:

The Current Ratio: This ratio compares current assets to current liabilities.

Current Ratio = Current Assets / Current Liabilities

A current ratio above 1 generally indicates sufficient liquidity.

The Quick Ratio: This ratio is a more conservative measure, excluding inventories from current assets.

Quick Ratio = (Current Assets – Inventories) / Current Liabilities

The quick ratio offers a more stringent assessment of immediate liquidity, as inventories might not be readily convertible to cash.

Capital Structure Comparison

Different capital structures – the mix of debt and equity financing – impact a company’s risk profile and its return on investment. A highly leveraged company (high debt) enjoys amplified returns during periods of growth, but faces increased risk during downturns. Conversely, a company with low debt (high equity) enjoys greater stability but might sacrifice potential growth. The optimal capital structure is a delicate balancing act, dependent on numerous factors, including industry norms, market conditions, and the company’s risk appetite. For example, a utility company might favor a conservative capital structure with low debt, while a technology startup might embrace higher leverage to fuel rapid growth.

Analyzing the Cash Flow Statement

The cash flow statement, often described as the “ugly duckling” of financial statements, is surprisingly crucial for a thorough investment analysis. While the income statement shows profits and the balance sheet displays assets and liabilities, the cash flow statement reveals the actual cash coming in and going out of a company – the lifeblood of any business. Ignoring it is like judging a book by its cover (and maybe its spine, too, for good measure).

The cash flow statement is divided into three main sections, each telling a different part of the company’s financial story. Understanding these sections is key to deciphering the company’s liquidity, solvency, and overall financial health. A mismatch between the reported profits and the actual cash flow can be a red flag, signaling potential problems that the other statements might mask.

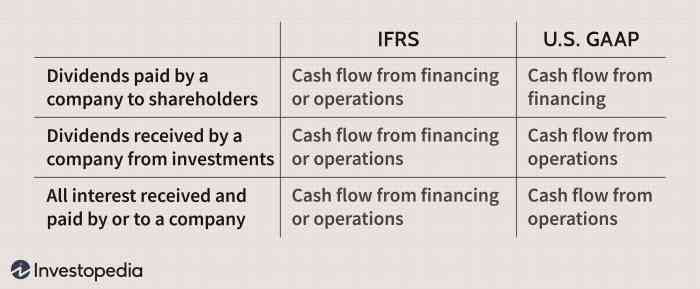

Cash Flow Statement Sections

The three main sections of the cash flow statement are operating activities, investing activities, and financing activities. Operating activities reflect cash flows from the company’s core business operations, such as sales and purchases. Investing activities represent cash flows related to long-term assets, like property, plant, and equipment (PP&E) acquisitions or sales. Financing activities cover cash flows related to debt, equity, and dividends. Analyzing each section provides a comprehensive view of how a company manages its cash. For example, a company with consistently strong operating cash flow but negative investing cash flow might be underinvesting in growth opportunities, while a company with strong investing cash flow but weak operating cash flow may be relying too heavily on acquisitions to boost its performance.

Free Cash Flow and Valuation

Free cash flow (FCF) is a critical metric derived from the cash flow statement. It represents the cash a company generates after accounting for capital expenditures (CapEx) – essentially, the cash available for distribution to shareholders, debt repayment, or reinvestment. Many valuation models, including discounted cash flow (DCF) analysis, rely heavily on FCF projections. A company with robust and predictable FCF is generally considered a more attractive investment than one with erratic or low FCF. For example, a company with consistently high FCF can easily service its debt, invest in new projects, and potentially return capital to shareholders through dividends or share buybacks. Conversely, a company with low or negative FCF might struggle to meet its financial obligations and may require additional financing. The calculation of FCF is typically:

Operating Cash Flow – Capital Expenditures

Strengths and Weaknesses of Using Cash Flow Statements for Investment Decisions

Understanding the strengths and weaknesses of using cash flow statements for investment decisions is crucial for a balanced perspective.

- Strengths: Provides a clear picture of a company’s liquidity, solvency, and ability to generate cash; crucial for valuation models; less susceptible to accounting manipulations compared to the income statement.

- Weaknesses: Can be affected by timing differences in cash inflows and outflows; doesn’t always reflect the full economic reality of a business; may not fully capture the value of intangible assets.

Trend Analysis and Forecasting

Predicting the future is a risky business, even for seasoned financial analysts. However, understanding historical trends and applying appropriate forecasting techniques can significantly improve your investment decisions, transforming you from a financial soothsayer to a shrewd investor. By analyzing the past performance of a company, we can glean insights into its likely future, though remember, even the best predictions are just educated guesses.

Trend analysis involves examining financial statement data over several periods to identify patterns and predict future performance. This isn’t about gazing into a crystal ball; it’s about using historical data to make informed decisions. Imagine you’re a detective investigating a crime – you wouldn’t just look at one clue; you’d examine the entire crime scene. Similarly, a comprehensive trend analysis examines multiple years of financial data to understand the bigger picture.

Methods of Trend Analysis

Trend analysis isn’t a one-size-fits-all approach. Several methods exist, each with its own strengths and weaknesses. Choosing the right method depends on the specific financial data being analyzed and the desired level of accuracy. The choice is yours, but choose wisely, for your investment future depends on it!

- Percentage Change Analysis: This simple yet effective method calculates the percentage change in a financial metric from one period to the next. For example, if a company’s revenue increased from $10 million to $12 million, the percentage change is 20%. This method quickly highlights growth or decline trends.

- Index Number Method: This method expresses the trend as an index number relative to a base year. For example, if we choose Year 1 as the base year (index=100), and Year 2 revenue increased by 10%, the index number for Year 2 would be 110. This method allows for easy comparison of trends across different metrics.

- Linear Regression: This statistical technique fits a straight line to the historical data, allowing for the prediction of future values. The equation of the line (y = mx + c, where y is the dependent variable, x is the independent variable, m is the slope, and c is the intercept) can be used to forecast future values. A strong correlation (R-squared value close to 1) indicates a good fit and greater confidence in the forecast. However, remember that linear regression assumes a linear relationship, which may not always be the case in the volatile world of finance.

Forecasting Techniques

Once trends are identified, forecasting techniques help project these trends into the future. These techniques, much like financial instruments themselves, come with varying degrees of risk and reward.

- Moving Averages: This method smooths out short-term fluctuations by averaging data points over a specific period. For example, a 3-year moving average of revenue would average the revenue of the past three years. This technique is particularly useful for identifying underlying trends in data with significant noise.

- Exponential Smoothing: This technique assigns exponentially decreasing weights to older data points, giving more weight to recent data. This method is better at adapting to recent changes than simple moving averages. Think of it as giving more credence to the latest market whispers.

- Time Series Analysis: This sophisticated statistical technique uses past data to identify patterns and forecast future values. It can account for seasonality, trends, and cyclical patterns. Time series analysis is a powerful tool but requires specialized software and expertise.

Using Trend Analysis and Forecasting for Investment Decisions

Trend analysis and forecasting are not crystal balls, but rather powerful tools to assess investment opportunities and risks. Identifying upward trends in revenue, profit margins, and cash flow suggests a healthy and potentially profitable investment. Conversely, downward trends might indicate impending financial trouble. For example, consistently declining sales figures for a particular company, coupled with rising debt levels, might signal a red flag, suggesting a high-risk investment. Conversely, a company showing consistent growth in earnings per share (EPS) over several years, alongside a strong balance sheet, might present a compelling investment opportunity. Remember, however, to always conduct thorough due diligence before making any investment decisions.

Comparative Company Analysis

Financial statement analysis isn’t just about scrutinizing a single company’s performance in isolation; it’s about understanding how that company stacks up against its rivals. Think of it as a financial beauty pageant, but instead of sashes and smiles, we’re looking at profit margins and debt ratios. Comparative company analysis provides a crucial perspective, allowing investors to identify undervalued gems or, conversely, avoid potential pitfalls disguised as shiny objects.

Comparing a company’s financial statements to its industry peers offers a wealth of benefits. By benchmarking performance against competitors, investors gain a clearer picture of a company’s relative strengths and weaknesses. This comparative view helps contextualize a company’s financial health, highlighting areas where it excels or lags behind its peers. For example, a company might boast high revenue growth, but a comparative analysis might reveal that this growth is significantly slower than that of its competitors, indicating potential problems. This nuanced understanding allows for more informed investment decisions, reducing the risk of investing in a company that appears successful in isolation but is actually underperforming relative to its industry.

Benchmark Company Selection

Choosing the right benchmark companies is paramount to a successful comparative analysis. A poorly chosen benchmark can lead to inaccurate conclusions and flawed investment strategies. Several methods exist for selecting appropriate companies. First, consider industry classification. Companies within the same industry, and ideally, with similar business models and sizes, provide the most meaningful comparisons. Second, geographic location matters; comparing a US-based company to a solely European competitor might yield misleading results due to differing economic conditions and regulatory environments. Third, consider financial characteristics. Companies with similar revenue size, market capitalization, and debt levels often offer the most relevant benchmarks. Ignoring these factors could lead to comparing apples and oranges, yielding insights as useful as comparing the speed of a snail to a cheetah. Finally, use reputable databases like Bloomberg or Refinitiv to access consistent and reliable financial data for your selected benchmarks.

Identifying Undervalued or Overvalued Companies

Comparative analysis is a powerful tool for identifying potentially undervalued or overvalued companies. By comparing key financial ratios—such as profitability ratios (gross profit margin, net profit margin, return on assets), liquidity ratios (current ratio, quick ratio), solvency ratios (debt-to-equity ratio, times interest earned), and efficiency ratios (inventory turnover, asset turnover)—across a company and its peers, investors can spot discrepancies. For instance, a company with significantly higher profit margins than its competitors, coupled with similar or lower debt levels, might be undervalued. Conversely, a company with consistently lower profit margins and higher debt levels than its peers might be overvalued. Remember, however, that a single ratio rarely tells the whole story. A holistic approach, considering multiple ratios and qualitative factors, is crucial for a comprehensive assessment. For example, consider a company with a high price-to-earnings ratio (P/E) compared to its peers. While this might suggest overvaluation, further investigation into its growth prospects and future earnings potential might reveal a justifiable premium. The key is to not just compare numbers, but to understand the context and underlying drivers of those numbers.

Illustrative Example

Let’s put our newfound analytical prowess to the test! We’ll dissect the financial statements of “Acme Explosives,” a hypothetical but surprisingly realistic company dealing in – you guessed it – explosives. Their financial success (or spectacular failure) will depend entirely on the market’s appetite for controlled detonations. Prepare for a thrilling ride through the world of balance sheets and income statements, where profits can be as volatile as dynamite.

Acme Explosives Company Profile

Acme Explosives is a mid-sized company specializing in the manufacturing and distribution of commercial explosives. They operate primarily in the construction and mining sectors, a market segment known for its cyclical nature and inherent risks. Their competitive advantage lies in their proprietary blend of explosives, which they claim is both more efficient and safer than competitors’ offerings. This claim, of course, needs rigorous verification through financial statement analysis.

Acme Explosives: Income Statement (Year Ended December 31, 2023)

| Revenue | $50,000,000 |

|---|---|

| Cost of Goods Sold | $25,000,000 |

| Gross Profit | $25,000,000 |

| Selling, General, and Administrative Expenses | $10,000,000 |

| Research and Development Expenses | $5,000,000 |

| Operating Income | $10,000,000 |

| Interest Expense | $1,000,000 |

| Income Before Taxes | $9,000,000 |

| Income Tax Expense | $2,700,000 |

| Net Income | $6,300,000 |

Acme Explosives: Balance Sheet (December 31, 2023)

| Assets | Liabilities & Equity | ||

|---|---|---|---|

| Current Assets: | Current Liabilities: | ||

| Cash | $2,000,000 | Accounts Payable | $5,000,000 |

| Accounts Receivable | $8,000,000 | Short-Term Debt | $2,000,000 |

| Inventory | $10,000,000 | Total Current Liabilities | $7,000,000 |

| Total Current Assets | $20,000,000 | Long-Term Debt | $10,000,000 |

| Non-Current Assets: | Equity: | ||

| Property, Plant, and Equipment | $30,000,000 | Common Stock | $10,000,000 |

| Total Assets | $50,000,000 | Retained Earnings | $23,000,000 |

| Total Equity | $33,000,000 | ||

| Total Liabilities & Equity | $50,000,000 |

Acme Explosives: Statement of Cash Flows (Year Ended December 31, 2023)

| Cash Flow from Operating Activities | $12,000,000 |

|---|---|

| Cash Flow from Investing Activities | -$5,000,000 |

| Cash Flow from Financing Activities | -$3,000,000 |

| Net Increase in Cash | $4,000,000 |

Financial Health Analysis of Acme Explosives

Acme Explosives shows a healthy net income, suggesting profitability. However, a closer look reveals some potential concerns. Their high level of accounts receivable ($8,000,000) warrants further investigation into their collection processes. Are they extending too much credit, potentially leading to bad debts?

High accounts receivable could indicate potential credit risk and slower cash conversion cycles. Further analysis is needed to assess the quality of these receivables.

Their significant investment in property, plant, and equipment ($30,000,000) indicates a commitment to long-term growth, but this also represents a substantial fixed asset investment, which can impact profitability if utilization rates are low.

A high proportion of fixed assets could suggest a capital-intensive business model, potentially impacting flexibility and responsiveness to market changes.

The cash flow statement shows a positive net increase in cash, which is a positive sign. However, the negative cash flow from investing activities suggests potential capital expenditures that might warrant further scrutiny. Are these investments aligned with their strategic goals and generating adequate returns?

Negative cash flow from investing activities needs careful examination. Were these investments necessary for future growth or are they a sign of inefficient capital allocation?

The company’s debt levels ($12,000,000) appear manageable relative to its equity ($33,000,000), but further analysis of debt ratios would provide a more complete picture of their financial leverage.

A detailed analysis of debt ratios, such as the debt-to-equity ratio, is crucial to assess Acme Explosives’ financial risk profile.

Final Summary

Mastering financial statement analysis for investing is not just about crunching numbers; it’s about gaining a powerful insight into a company’s true financial health. By understanding the intricacies of these statements and employing the techniques Artikeld in this guide, you’ll be empowered to make informed investment decisions, maximizing your returns and minimizing your risks. So, grab your calculator, sharpen your pencils, and embark on this enlightening journey toward becoming a financially astute investor. Remember, the numbers may be dry, but the potential rewards are anything but!

Clarifying Questions

What are some common mistakes investors make when analyzing financial statements?

Overlooking qualitative factors, misinterpreting ratios without context, failing to perform trend analysis, and neglecting comparative analysis are common pitfalls.

How often should I analyze a company’s financial statements?

Regularly, at least quarterly for publicly traded companies, to monitor performance and identify emerging trends. More frequent analysis may be warranted depending on the investment strategy and market conditions.

Where can I find financial statements for privately held companies?

Access to private company financial statements is generally limited. Information may be available through private equity databases or direct requests to the company (though this is not guaranteed).

What software can assist with financial statement analysis?

Spreadsheet software (like Excel) is a common tool. Dedicated financial analysis software and platforms offer more advanced features.