Financial Statement Analysis in Healthcare

Financial statement analysis in healthcare: It sounds about as thrilling as a root canal, right? Wrong! Delving into the numbers behind hospitals and healthcare systems reveals a surprisingly dramatic world of revenue cycles, regulatory hurdles, and the constant quest for solvency. This isn’t just about balancing the books; it’s about understanding the lifeblood of an industry that keeps us all ticking. Prepare for a financial adventure, complete with spreadsheets, ratios, and the occasional unexpected profit (or loss – let’s be realistic!).

This exploration will dissect the key financial statements – the balance sheet (assets, liabilities, and that elusive thing called equity), the income statement (revealing the glorious revenue and the less-glorious expenses), and the cash flow statement (the true story of where the money actually goes). We’ll navigate the unique challenges of healthcare finance, from government reimbursements to the ever-increasing cost of medical supplies. Get ready for ratio analysis (because numbers love to be compared), a deep dive into revenue and expenses, and a peek into the crystal ball of financial forecasting. Buckle up, it’s going to be a wild ride!

Introduction to Healthcare Financial Statements

Navigating the labyrinthine world of healthcare finance can feel like trying to decipher hieroglyphics while juggling chainsaws. But fear not, intrepid accountant! Understanding the key financial statements is the first step towards mastering this thrilling, if occasionally terrifying, domain. These statements provide a crucial window into the financial health of a healthcare organization, revealing its profitability, liquidity, and overall financial stability. Think of them as your trusty financial X-ray machine, allowing you to see beneath the surface and diagnose potential problems before they become full-blown crises.

Healthcare financial statements, while sharing some similarities with those in other industries, possess unique characteristics that reflect the complexities of the healthcare landscape. Reimbursement models, regulatory pressures, and the sheer volume of transactions involved contribute to a distinct financial reporting environment. Ignoring these nuances is like trying to build a house on a foundation of jelly – it’s going to end badly.

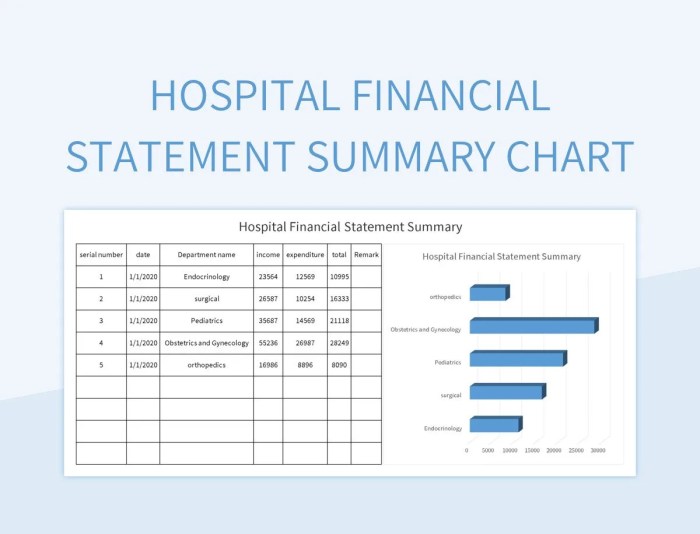

Key Financial Statements in Healthcare

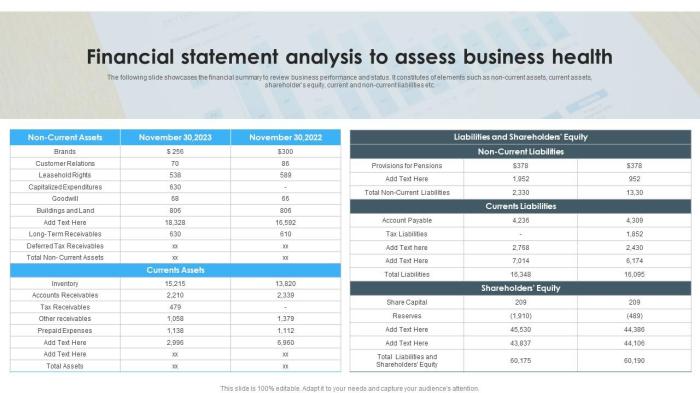

The three primary financial statements – the balance sheet, the income statement, and the cash flow statement – are the cornerstones of healthcare financial analysis. The balance sheet provides a snapshot of a healthcare organization’s assets, liabilities, and equity at a specific point in time. It’s like a photograph of the organization’s financial position – a frozen moment in time that reveals what it owns, what it owes, and the value belonging to its owners. The income statement, on the other hand, shows the organization’s revenues and expenses over a period of time, revealing its profitability. This is akin to a movie, showcasing the flow of money in and out over a specific timeframe, ultimately revealing whether the organization is making money or losing it. Finally, the statement of cash flows tracks the movement of cash in and out of the organization, revealing its liquidity. This is your organization’s financial heartbeat, demonstrating the organization’s ability to meet its short-term obligations and fund its operations.

Unique Characteristics of Healthcare Financial Statements

Unlike other industries, healthcare financial statements often grapple with complex reimbursement methodologies (think Medicare and Medicaid). These reimbursements, often based on Diagnosis-Related Groups (DRGs) or other value-based models, can significantly impact an organization’s revenue and profitability. The prevalence of government regulations and compliance requirements adds another layer of complexity, demanding meticulous record-keeping and adherence to strict accounting standards. Furthermore, the high volume of transactions, involving numerous patients, providers, and insurers, requires robust accounting systems and internal controls to ensure accuracy and efficiency.

Importance of Understanding Healthcare Financial Statements

Effective healthcare management hinges on a deep understanding of these financial statements. Analyzing these statements allows healthcare leaders to make informed decisions about resource allocation, strategic planning, and operational efficiency. For example, identifying trends in revenue and expenses can help in predicting future financial performance and adjusting strategies accordingly. Analyzing cash flow can help in managing liquidity and ensuring the organization has sufficient funds to meet its obligations. Without this understanding, healthcare organizations risk operating blindly, potentially leading to financial instability and even failure. Essentially, understanding these statements is not just beneficial; it’s essential for survival in this dynamic and demanding industry. Think of it as the difference between navigating a minefield with a map and compass, versus stumbling through blindfolded – one approach is considerably more likely to lead to success.

Ratio Analysis in Healthcare Finance

Analyzing healthcare financial statements is like deciphering a particularly cryptic treasure map – filled with clues, but requiring careful interpretation to uncover the buried gold (or, you know, profitability). While the statements themselves provide a wealth of information, ratio analysis is the magnifying glass that helps us truly understand the financial health of a healthcare organization. It allows us to compare performance across time, against industry benchmarks, and even against competitors – all vital for strategic decision-making.

Ratio analysis transforms raw financial data into meaningful insights, revealing hidden trends and potential problem areas before they snowball into full-blown crises. Think of it as a financial checkup for hospitals and clinics – a vital tool for ensuring long-term sustainability and success.

Key Financial Ratios in Healthcare

Several key ratios provide a comprehensive assessment of a healthcare organization’s financial standing. These ratios are broadly categorized into liquidity, profitability, solvency, and efficiency ratios. Each category offers a different perspective, allowing for a holistic understanding of the organization’s financial health. A balanced view across these categories is crucial for informed decision-making.

Ratio Analysis Table: A Comparative Look

The following table summarizes five key ratios, their formulas, and their interpretations within a healthcare context. Remember, the ideal values for these ratios vary depending on the specific type of healthcare organization, its size, and the market it operates in. This table provides a general guideline, and further research tailored to a specific organization is always recommended.

| Ratio Name | Formula | Interpretation (Healthcare Context) | Example |

|---|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Measures the ability to meet short-term obligations. A higher ratio indicates greater liquidity, suggesting a lower risk of defaulting on short-term debts. In healthcare, this is particularly important given the constant need for supplies and staffing. | A current ratio of 2.0 suggests the organization has twice the current assets as current liabilities, indicating strong liquidity. |

| Operating Margin | Operating Income / Operating Revenue | Indicates profitability from core operations. A higher margin suggests greater efficiency in managing operational expenses. In healthcare, a higher margin might indicate effective cost control and efficient service delivery. | An operating margin of 5% means that for every $100 of operating revenue, $5 is operating income. |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Measures the proportion of financing from debt versus equity. A higher ratio indicates greater reliance on debt financing, potentially increasing financial risk. In healthcare, this is relevant as expansion projects often require significant capital investment. | A debt-to-equity ratio of 0.5 means that for every $1 of equity, the organization has $0.5 of debt. |

| Days in Accounts Receivable | (Net Accounts Receivable / Net Credit Sales) * 365 | Measures the average number of days it takes to collect payments from patients and insurers. A shorter collection period improves cash flow. In healthcare, timely collections are crucial for maintaining operational stability. | Days in Accounts Receivable of 45 days suggests that, on average, it takes 45 days to collect payments. |

| Total Asset Turnover | Net Revenue / Average Total Assets | Measures how effectively assets are used to generate revenue. A higher ratio indicates greater efficiency in asset utilization. In healthcare, this can reflect the effectiveness of investments in equipment and facilities. | A total asset turnover of 1.5 means that for every $1 of average total assets, the organization generates $1.5 of net revenue. |

Limitations of Ratio Analysis

While ratio analysis is an invaluable tool, relying solely on it can be misleading. It’s crucial to remember that ratios are just snapshots in time, and they don’t tell the whole story. For example, a seemingly healthy current ratio might mask underlying issues with accounts receivable or inventory management. Furthermore, comparing ratios across different healthcare organizations can be challenging due to variations in accounting practices, patient populations, and reimbursement models. Ratio analysis should be used in conjunction with other analytical methods and qualitative factors for a more comprehensive assessment. Think of it as one piece of the puzzle, not the entire picture. Ignoring other factors can lead to a seriously skewed understanding of a healthcare organization’s financial reality.

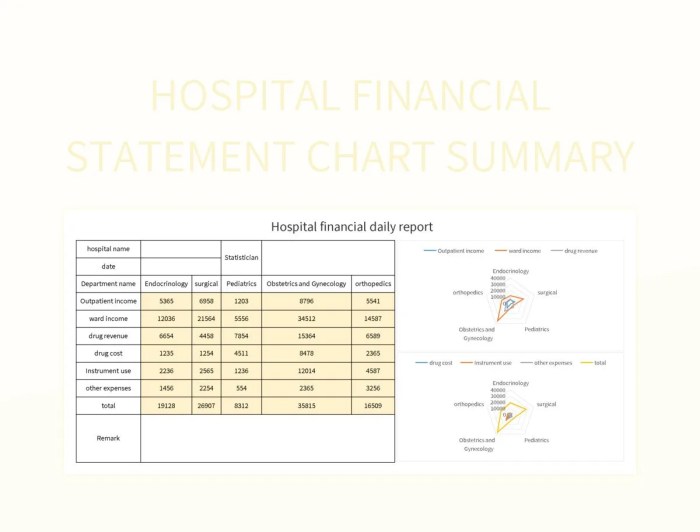

Analyzing Revenue and Expenses in Healthcare

The financial health of a healthcare organization, much like a patient’s, requires careful monitoring of both its intake (revenue) and its outgoings (expenses). Understanding the intricate dance between these two factors is crucial for ensuring profitability and sustainable operations. Think of it as a well-choreographed financial ballet – a beautiful sight when done right, a complete disaster when it’s not.

Analyzing revenue and expenses in healthcare involves dissecting the various sources of income and expenditure to identify trends, assess efficiency, and pinpoint areas for improvement. It’s a detective story, really, where the clues lie in the numbers, and the goal is to solve the mystery of financial well-being.

Healthcare Revenue Streams

Healthcare organizations, unlike your average lemonade stand, have a more diverse portfolio of revenue streams. The primary sources of income typically include patient services revenue, government reimbursements (a complex beast in itself), and other operating revenue. Patient services revenue is the bread and butter, representing direct payments from patients for services rendered. Government reimbursements, often through programs like Medicare and Medicaid, are a significant portion of the revenue for many providers, involving intricate billing processes and regulations that can make even seasoned accountants weep. Finally, other operating revenue encompasses a variety of sources, from cafeteria sales (don’t underestimate the power of a well-run hospital cafeteria!) to investment income.

Major Expense Categories in Healthcare

The expenses side of the ledger is equally fascinating, and perhaps even more dramatic. Healthcare organizations are notorious for their high operating costs. Salaries and benefits are typically the biggest chunk, reflecting the significant workforce required to deliver care. Supplies, ranging from bandages to sophisticated medical equipment, represent another substantial expense category, constantly fluctuating with technological advancements and patient needs. Depreciation, the accounting process that reflects the gradual decline in value of assets like buildings and equipment, adds another layer of complexity to the financial picture. Consider the cost of a new MRI machine, for instance; its depreciation over time is a significant expense to factor into the budget.

Strategies for Improving Revenue Cycle Management

Efficient revenue cycle management is paramount for the financial health of any healthcare provider. A well-oiled revenue cycle translates directly into improved profitability and financial stability. Here are some key strategies:

Improving revenue cycle management requires a multi-pronged approach. Think of it as a well-orchestrated symphony, where each section (billing, coding, collections) plays its part harmoniously to create a financially healthy melody.

- Streamline the billing process: Implement electronic health records (EHRs) and automated billing systems to reduce manual errors and accelerate payments. Imagine the efficiency gains – less paperwork, fewer headaches, more money in the bank!

- Enhance claims processing: Accurate and timely submission of claims is crucial. Investing in robust claims management software and training staff on proper coding practices can significantly reduce denials and accelerate reimbursement.

- Improve patient communication: Clear communication regarding billing and payment options can minimize disputes and improve patient satisfaction. Think of it as proactive customer service – a happy patient is a paying patient.

- Implement robust accounts receivable management: Effective strategies for managing outstanding payments, such as proactive follow-up and establishing clear payment plans, are essential for maximizing revenue collection. This is the financial equivalent of a diligent debt collector, ensuring timely payments without alienating patients.

Assessing Liquidity and Solvency in Healthcare

Maintaining a healthy financial state in healthcare is a tightrope walk between providing excellent patient care and ensuring the organization’s long-term viability. This requires a keen understanding of both liquidity – the ability to meet short-term obligations – and solvency – the ability to meet long-term obligations. Let’s delve into the crucial ratios that illuminate this financial tightrope.

Liquidity Ratios: A Quick Look at Short-Term Financial Health

Liquidity ratios gauge a healthcare provider’s ability to pay its bills as they come due. A low ratio can signal potential trouble, while a high ratio might suggest inefficient use of assets. Two key ratios are the current ratio and the quick ratio. The current ratio compares current assets (cash, accounts receivable, and inventory) to current liabilities (accounts payable, short-term debt). The quick ratio is similar but excludes inventory, as it’s often the least liquid asset.

Current Ratio and Quick Ratio: A Comparative Analysis

The current ratio provides a broader view of short-term liquidity, including the value of inventory. However, inventory in healthcare, which might include pharmaceuticals or medical supplies, may not be easily converted to cash. The quick ratio offers a more conservative measure by focusing on readily convertible assets. A healthcare provider with a high current ratio but a low quick ratio might be heavily reliant on inventory sales to meet short-term obligations, which could be risky if sales slow down. For example, a hospital with a current ratio of 2.0 and a quick ratio of 1.0 indicates that while it has sufficient current assets to cover current liabilities, a significant portion of those assets are tied up in inventory.

Solvency Ratios: The Long-Term Financial Picture

Solvency ratios provide insight into a healthcare organization’s ability to meet its long-term obligations. These ratios assess the organization’s capital structure and its ability to withstand financial stress. Key solvency ratios include the debt-to-equity ratio and the times interest earned ratio.

Debt-to-Equity Ratio: Leverage and Risk

The debt-to-equity ratio indicates the proportion of a healthcare organization’s financing that comes from debt versus equity. A high ratio suggests a higher reliance on debt financing, increasing financial risk. However, debt financing can be a powerful tool for expansion and improvement if managed carefully. For instance, a hospital using debt to finance a new wing might experience a temporary increase in its debt-to-equity ratio, but the increased capacity could lead to higher revenue and improved solvency in the long run. The key is responsible debt management.

Times Interest Earned Ratio: Debt Servicing Ability

The times interest earned (TIE) ratio measures a healthcare organization’s ability to meet its interest obligations on debt. It compares earnings before interest and taxes (EBIT) to interest expense. A low TIE ratio indicates difficulty in servicing debt, potentially signaling financial distress. A hospital with a TIE ratio of less than 1.0 is clearly struggling to cover its interest payments. Conversely, a ratio significantly above 1.0 suggests comfortable debt servicing capacity.

The Impact of Debt Financing on Healthcare Organizations’ Financial Stability

Debt financing can be a double-edged sword. While it can fuel growth and modernization, excessive debt can severely strain an organization’s financial stability. Careful planning, responsible borrowing, and a robust revenue stream are essential for managing debt effectively. A hospital system expanding rapidly using significant debt financing might experience financial instability if unexpected economic downturns or reduced patient volume affect revenue generation. Strategic financial planning and diversification of funding sources are crucial to mitigating such risks. The ability to secure favorable loan terms and manage debt repayment schedules is paramount to long-term financial health.

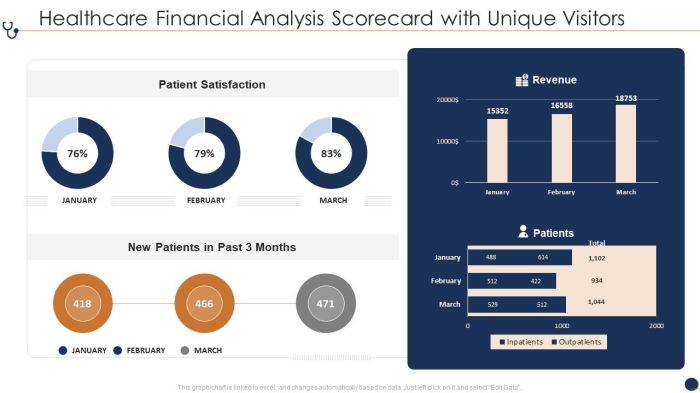

Benchmarking and Comparative Analysis

So, you’ve diligently analyzed your hospital’s financials. You’ve wrestled with ratios, tamed unruly expense reports, and even managed to decipher the mysteries of liquidity. But now comes the truly thrilling part: comparing your performance to the competition. Think of it as the financial equivalent of a healthcare Olympics – except instead of gold medals, you’re vying for optimal efficiency and profitability. Benchmarking lets you see where you stand in the grand scheme of things, and it’s way more fun than staring at spreadsheets all day.

Benchmarking healthcare financial performance involves comparing your organization’s key financial metrics against those of similar institutions. This might involve comparing your hospital’s operating margin to the average operating margin of other hospitals of comparable size and location, or comparing your patient days to those of your competitors. The goal is to identify areas where your organization excels and areas where improvements are needed. Think of it as a financial health checkup, but instead of a doctor, you have industry averages to guide you. This comparative analysis helps reveal hidden strengths and weaknesses, allowing for strategic planning and improvements.

Sources of Benchmarking Data

Finding reliable benchmarking data is crucial for effective comparative analysis. Several publicly available databases and resources provide healthcare financial information. These resources often categorize data by factors such as hospital size, location, ownership type (for-profit, not-for-profit), and service offerings. This allows for more nuanced comparisons and avoids the pitfalls of comparing apples and oranges (or, in this case, large urban teaching hospitals with small rural critical access hospitals). Ignoring these factors could lead to inaccurate and misleading conclusions, potentially resulting in misguided strategic decisions.

Challenges and Limitations of Benchmarking

While benchmarking offers invaluable insights, it’s not without its challenges. One significant hurdle is the inherent variability in healthcare data. Different accounting practices, variations in patient populations, and differing levels of technology adoption can all skew comparisons. For example, a hospital specializing in complex cardiac surgery will naturally have higher costs than one focusing on primary care. Direct comparisons without considering these factors would be misleading. Furthermore, publicly available data often lags, meaning the information you are using might not reflect the most current financial picture. This lag can make strategic planning based on the data more challenging, as the situation on the ground may have already changed significantly. Finally, benchmarking data usually only provides averages, masking the variations within the dataset. You may find that your hospital performs similarly to the top 10% of hospitals in one area but falls within the bottom 20% in another. This nuance is often lost in simple average comparisons.

Analyzing Cash Flow in Healthcare Organizations

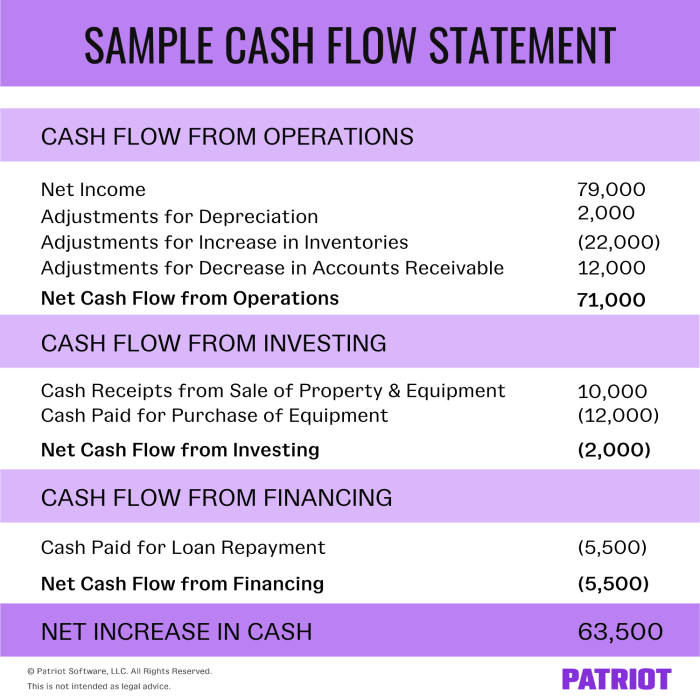

Cash flow, the lifeblood of any organization, is especially crucial in healthcare. While hefty profits might paint a rosy picture, a weak cash flow can quickly lead to a financial crisis – think of it as having a full bank account but no readily available cash to pay the bills. Understanding a healthcare organization’s cash flow statement is therefore not just accounting 101, it’s survival 101.

The cash flow statement provides a detailed look at where money is coming from and going to, offering a more dynamic view than the static snapshot of a balance sheet. Unlike accrual accounting, which recognizes revenue when earned and expenses when incurred, the cash flow statement focuses solely on actual cash inflows and outflows. This is essential for understanding the organization’s liquidity and ability to meet its short-term obligations. Ignoring it is like driving a car without checking your fuel gauge – eventually, you’ll run out of gas.

Components of the Healthcare Cash Flow Statement, Financial statement analysis in healthcare

The healthcare organization’s cash flow statement is typically divided into three main sections: operating, investing, and financing activities. Operating activities represent the cash flows generated from the core business operations, such as patient services, pharmaceutical sales, and insurance reimbursements. Investing activities involve the purchase and sale of long-term assets, such as medical equipment, buildings, and investments. Financing activities cover the organization’s funding sources, including debt issuance, equity financing, and dividend payments. Understanding the interplay between these three sections is key to assessing the organization’s overall financial health. A consistent pattern of strong operating cash flow is a positive sign, while significant outflows in investing activities might signal over-expansion or inefficient capital allocation.

Interpreting Cash Flow Trends

Analyzing trends in cash flow over time reveals important insights into the organization’s financial stability and liquidity. A consistent increase in operating cash flow indicates a healthy and growing business. Conversely, a persistent decline can signal underlying problems, such as declining patient volumes, rising operating costs, or inefficient revenue cycle management. Analyzing the cash flow from investing activities can reveal the organization’s capital expenditure strategy. Large outflows might indicate significant investments in new equipment or facilities, while substantial inflows suggest asset sales or divestments. Examining financing activities reveals how the organization funds its operations and investments. A reliance on short-term debt can indicate liquidity issues, while consistent equity financing suggests a strong financial foundation.

Scenario: Strong Profits, Weak Cash Flow

Imagine a hospital boasting record profits but struggling to meet its payroll. This seemingly paradoxical situation is more common than you might think. Several factors could contribute to this: slow payment cycles from insurers (leading to a significant delay in cash collection despite accrued revenue), significant capital expenditures (such as purchasing new MRI machines), or aggressive expansion plans that drain cash reserves. Solutions could involve improving revenue cycle management to accelerate cash collection, negotiating more favorable payment terms with insurers, prioritizing investments, delaying non-essential capital expenditures, or exploring alternative financing options such as lines of credit. This scenario underscores the importance of analyzing both profitability and cash flow to get a complete picture of the organization’s financial health. It’s not enough to be profitable; you need to have the cash to actually operate.

Impact of Regulatory Changes on Healthcare Finances

Navigating the choppy waters of healthcare finance requires a sturdy vessel and a keen eye for the shifting currents of regulation. Governmental oversight, while sometimes feeling like a bureaucratic kraken, plays a significant role in shaping the financial landscape of healthcare organizations. Understanding these regulations is crucial for survival, and, dare we say, even for prosperity.

The influence of government regulations, particularly those wielded by Medicare and Medicaid, is profound and pervasive. These behemoths of the healthcare system dictate reimbursement rates, eligibility criteria, and a whole host of other stipulations that directly impact a healthcare organization’s bottom line. Imagine trying to run a lemonade stand where the government sets the price of lemonade and dictates who can buy it – that’s essentially the challenge faced by many healthcare providers.

Government Regulation Influence on Healthcare Financial Statements

Government regulations significantly impact healthcare financial statements by influencing revenue streams and operational costs. Medicare and Medicaid reimbursement rates, for example, are often set below the actual cost of providing services, creating pressure on margins. Compliance requirements, such as those related to HIPAA (Health Insurance Portability and Accountability Act) and meaningful use of electronic health records (EHRs), necessitate substantial investments in technology and personnel, further impacting profitability. These costs are reflected in the expense side of the financial statements, directly affecting the organization’s net income. For instance, a hospital might show a decrease in net income due to lower-than-expected reimbursement from Medicare, coupled with increased expenses from EHR implementation and compliance training. This isn’t just about numbers on a page; it’s about the real-world impact on a hospital’s ability to invest in new equipment, recruit top talent, and maintain its services.

Impact of Healthcare Reform on Reimbursement Models

Healthcare reform initiatives, such as the Affordable Care Act (ACA) in the United States, have significantly reshaped reimbursement models. The shift towards value-based care, which emphasizes quality over quantity, has led to a move away from fee-for-service models towards bundled payments and pay-for-performance programs. This means healthcare organizations are increasingly incentivized to improve patient outcomes and reduce costs, rather than simply maximizing the number of procedures performed. For example, a hospital might receive a bundled payment for a hip replacement, encompassing all costs associated with the procedure from pre-operative care to post-operative rehabilitation. The success of this model depends on the hospital’s ability to manage costs efficiently while ensuring high-quality patient care. Failure to do so can lead to financial losses, even if the number of hip replacements performed remains consistent.

Examples of Regulatory Changes Affecting Healthcare Organization Profitability

The implementation of new regulations often leads to unforeseen consequences for healthcare organizations. For example, the introduction of stricter regulations on hospital readmissions resulted in hospitals focusing more on post-discharge care, leading to increased costs in certain areas while potentially reducing overall expenses from readmissions. Similarly, changes in drug pricing regulations can dramatically impact pharmaceutical company profitability, affecting their revenue and overall financial standing. These examples illustrate how seemingly small changes in regulations can ripple through the entire healthcare ecosystem, significantly influencing the profitability and financial planning of healthcare organizations. Proactive financial planning and a deep understanding of regulatory changes are essential for mitigating these risks and ensuring the long-term financial health of healthcare providers.

Financial Statement Analysis and Strategic Decision-Making: Financial Statement Analysis In Healthcare

Financial statement analysis isn’t just for accountants hiding in dimly lit offices; it’s the lifeblood of smart strategic decision-making in the often-chaotic world of healthcare. By dissecting the numbers, healthcare organizations can gain a crystal-clear view of their financial health, allowing them to make informed choices that impact everything from building new wings to buying up smaller practices. Think of it as a financial X-ray, revealing hidden strengths and weaknesses before they become major headaches.

Analyzing financial statements allows healthcare organizations to make data-driven decisions, rather than relying on gut feelings or guesswork. This approach minimizes risk and maximizes the chances of success in various strategic initiatives. It’s like having a financial GPS guiding you towards profitability and sustainability.

Capital Budgeting Decisions

Capital budgeting, the process of deciding which long-term investments to make, is significantly influenced by financial statement analysis. For example, a hospital considering building a new cardiac catheterization lab needs to analyze its current cash flow, debt levels, and projected revenue streams to determine if the project is financially viable. A strong balance sheet demonstrating sufficient liquidity and a healthy profit margin will significantly improve the chances of securing financing and making the project a success. Conversely, a struggling organization with high debt and low profitability might need to reconsider, perhaps focusing on smaller, less capital-intensive improvements. Failing to perform a thorough financial analysis in this context could lead to financial ruin – a situation far more stressful than a simple case of Monday morning blues.

Mergers and Acquisitions

Financial statement analysis plays a crucial role in mergers and acquisitions. Before acquiring another healthcare organization, a potential buyer must meticulously analyze the target’s financial statements to assess its financial health, profitability, and operational efficiency. This involves examining key ratios such as profitability ratios (net profit margin, return on assets), liquidity ratios (current ratio, quick ratio), and solvency ratios (debt-to-equity ratio). A thorough analysis helps to identify potential risks and opportunities, ensuring that the acquisition aligns with the buyer’s strategic goals and doesn’t result in a costly mistake. Imagine trying to merge two hospitals without knowing if one is secretly drowning in debt! The resulting financial turmoil could be…well, let’s just say it wouldn’t be pretty.

Service Line Expansion or Downsizing

Decisions regarding service line expansion or downsizing also hinge heavily on financial analysis. A hospital considering expanding its oncology services needs to project future revenue and expenses based on market demand, competitor analysis, and the cost of new equipment and staff. This involves forecasting future financial statements and evaluating the profitability of the proposed expansion. Similarly, if a service line is consistently losing money (as evidenced by detailed financial statement analysis), downsizing or even eliminating it might be the fiscally responsible choice, despite emotional attachment or perceived prestige. Analyzing historical data on patient volumes, revenue generation, and operating costs is crucial to making informed decisions about resource allocation. Ignoring these numbers can lead to prolonged financial bleeding, ultimately jeopardizing the entire organization’s stability.

Hypothetical Scenario: The Case of Sunnyvale General

Sunnyvale General Hospital is considering launching a new robotic surgery program. Their current financial statements show a healthy operating margin, but significant capital expenditures are planned for the next few years, including upgrading their aging IT infrastructure. To assess the feasibility of the robotic surgery program, they must perform a comprehensive financial analysis. This includes:

* Projecting the incremental revenue generated by the new program, based on estimated patient volume and procedure pricing.

* Estimating the incremental expenses, including the cost of the robotic surgery system, specialized training for surgeons and staff, and ongoing maintenance costs.

* Calculating the return on investment (ROI) for the robotic surgery program, considering the initial investment, projected revenue, and operating expenses.

* Analyzing the impact of the program on the hospital’s overall financial ratios, such as liquidity and solvency.

* Comparing the projected ROI of the robotic surgery program with other potential investment opportunities.

Based on this analysis, Sunnyvale General can determine whether the robotic surgery program is a financially sound investment, or if they should perhaps prioritize other projects, like finally fixing that leaky roof. Without this rigorous financial analysis, the hospital risks a costly and potentially disastrous misallocation of resources.

Conclusion

So, there you have it: a whirlwind tour of healthcare financial statement analysis. While the intricacies might initially seem daunting (and perhaps slightly dull – we won’t lie), understanding these financial statements is crucial for the health and well-being (financial, that is) of any healthcare organization. From strategic decision-making to ensuring long-term sustainability, mastering the art of analyzing these reports is akin to possessing a healthcare superpower. Now go forth and conquer those spreadsheets – and maybe treat yourself to a celebratory latte after deciphering a particularly tricky ratio.

Essential FAQs

What is the difference between liquidity and solvency?

Liquidity refers to a company’s ability to meet its short-term obligations, while solvency refers to its ability to meet its long-term obligations. Think of liquidity as having enough cash on hand for immediate needs, and solvency as having a sustainable business model for the long haul.

How can I improve my understanding of healthcare-specific financial statements?

Seek out industry-specific resources, such as professional journals, webinars, and continuing education courses focused on healthcare finance. Networking with other healthcare finance professionals can also be invaluable.

What are some common pitfalls to avoid in healthcare financial statement analysis?

Overreliance on a single ratio, neglecting qualitative factors (like patient satisfaction scores), and failing to consider the impact of regulatory changes are all potential pitfalls. A holistic approach is key.